MYOB has rolled out an exciting array of new features in the 2024.1 Spring Release, boosting functionality with industry-specific capabilities, a smooth customer experience, and the latest technology.

Each of these features will be detailed under their respective capability areas and include:

-

Case Management Enhancements

-

Pro-Forma Processing Enhancements

-

Distribution Requirements Planning

-

MRP Enhancements

-

Use of GI as Data Sources for a GI

Reversing a Cash Purchase Doc

Streamline the processing of immediate cash and card returns

With this release, the cash purchase processing functionality has been improved. Users can now create a cash return document to register a full or partial refund for items paid immediately. On the Cash Purchases (AP304000) form, a document of the Cash Return type can now be created.

The key benefits of this feature include a more comprehensive and streamlined workflow, making the management of cash purchases and refunds more efficient and enhancing the overall financial management process.

Illustration of Feature Utilisation in MYOB Acumatica

Users can now generate a new document type called 'Cash Return' to record either a full or partial refund for items paid immediately. The system automatically transfers all details from the original transaction to the cash return when the 'Return' button is selected within the Cash Purchases form.

Cash Discounts and Terms in Credit Memo

Allow the application of credit terms on credit memos and the creation of credit memos with cash discounts.

Previously, the system did not permit users to specify due dates and cash discounts on credit memos. This caused complications when a company offered a cash discount on a sale, the customer paid the reduced price, and then returned the items. The credit memo was issued without the cash discount, even though the seller intended to refund only the discounted amount.

In this release, a new setting in the AR Preferences form called 'Use Credit Terms in Credit Memos' has been introduced. This setting activates the terms field for credit memos within Accounts Receivable and Order Management. When terms are applied to a credit memo, the system automatically calculates a due date and a cash discount amount based on the specified terms, similar to how it does for invoices.

The due date is utilised in accounts receivable reports, customer statements, and cash flow forecasting. If a credit memo with a cash discount is selected for a refund or payment, the system will recommend taking the cash discount if the payment is made before the cash discount date.

Administrators can enable the use of credit terms for credit memos, allowing users to create credit memos with cash discounts.

The key benefits of this feature include:

-

Creating credit memos that accurately reflect the terms and cash discounts of the original invoices.

-

Enhanced cash flow forecasting by incorporating credit memos with due dates and cash discounts.

-

Improved accuracy of AR aging reports and customer statements by correctly calculating due dates and cash discounts for credit memos.

Example use in MYOB Acumatica

When processing a credit memo for an invoice with a 3% cash discount, and credit terms for credit memos are enabled, the terms field is editable and defaults to the original invoice's terms. The due date and cash discount are determined by these terms, but they can be overridden if necessary.

If a refund is issued for the memo within the cash discount period, the system will adjust the refunded amount by the cash discount. This feature can be toggled on or off as needed. If a credit memo has a due date, this date will be used in agent reports and customer statements; otherwise, the system will use the document date. If a cash discount was calculated for a credit memo based on the terms, it can be applied to refunds and payments.

Cash Discounts and Terms in Debit Adjustments

Enhance financial management and planning by enabling users to specify due dates and cash discounts in debit adjustments.

In the past, users couldn't set due dates for debit adjustments, which meant these adjustments always showed up as current in AP aging reports, making cash flow forecasting tricky. Plus, adding a cash discount to a debit adjustment wasn't an option. So, if you reversed a bill with a cash discount, the debit adjustment wouldn't reflect that discount. But with the MYOB Acumatica 2024.1 release, you can now set credit terms for debit adjustments and include cash discounts, making things much smoother!- Enhanced Financial Management

- Improved Configuration

- Increased Useability

Expense Refunds to Corporate Credit Cards

Boosts the efficiency and accuracy of financial management, especially when handling refunds and reconciling corporate credit card transactions.

Previously, customers had to manually void original expense documents and re-enter details to process refunds for corporate card expenses. This method was not only time-consuming but also prone to errors, increasing the risk of discrepancies in financial records.

The MYOB Acumatica 2024.1 release introduces a handy feature that allows for the entry and processing of negative expense receipts. This feature is designed to make full or partial refunds to corporate credit cards a breeze, streamlining the General Ledger (GL) account reconciliation process. By enabling negative expense receipts, users can manage refunds more efficiently, ensuring that corporate credit card transactions are accurately reflected in the GL accounts. This enhancement significantly improves the efficiency and accuracy of financial workflows, particularly in handling refunds and reconciling corporate credit card transactions.

The key benefits of this feature include:

- Refund Management: Makes issuing refunds to corporate credit cards simple. Users can easily process full or partial refunds, ensuring these transactions are accurately recorded in the financial records.

- GL Account Reconciliation: By enabling negative expense receipts, the feature makes General Ledger (GL) account reconciliation faster and simpler. This ensures that all transactions, including refunds, are accurately recorded and matched, reducing discrepancies and improving financial accuracy.

- Efficiency in Financial Workflow: The feature streamlines the financial workflow by cutting down the manual steps required to handle refunds. This not only saves time but also minimizes the risk of errors, making the overall process more efficient.

- Improved Financial Records: Accurate processing of negative expense receipts ensures that financial records are up-to-date and reflect the true financial position of the company. This is crucial for financial reporting and analysis.

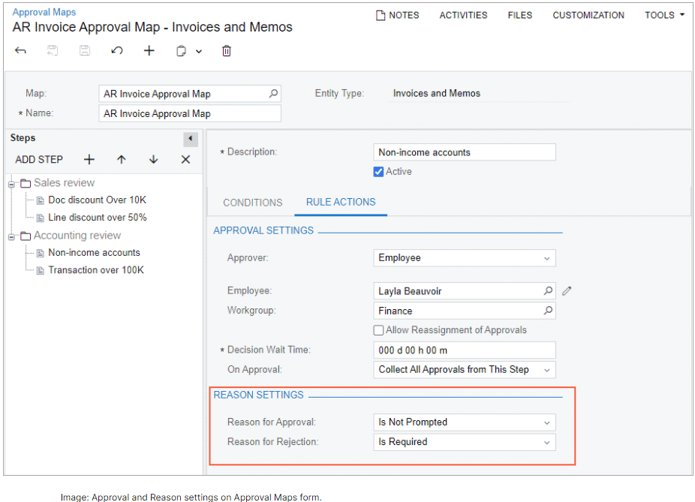

Approval and Rejection Reasons of Financial Forms

- Bills and Adjustments (AP301000)

- Invoices and Memos (AR301000)

- Cheques and Payments (AP302000)

- Payments and Applications (AR302000)

- Cash Transactions (CA304000)

- Cash Sales (AR304000)

- Cash Purchases (AP304000)

- Better Visibility and Accountability: This feature lets companies require approvers to give a reason for their decisions, promoting transparency.

- Improved Decision Making: By providing context and insight, this feature helps businesses make better future decisions and understand past ones.

Example use in MYOB Acumatica

AP Aging by Project Reports

Get a Clear View of Your Project's Cash Flow and Financial Health

-

Better Visibility into the financial health of each project.

-

More Insights to help you make informed decisions.

-

Improved ability to forecast cash flow by project.

Example use in MYOB Acumatica

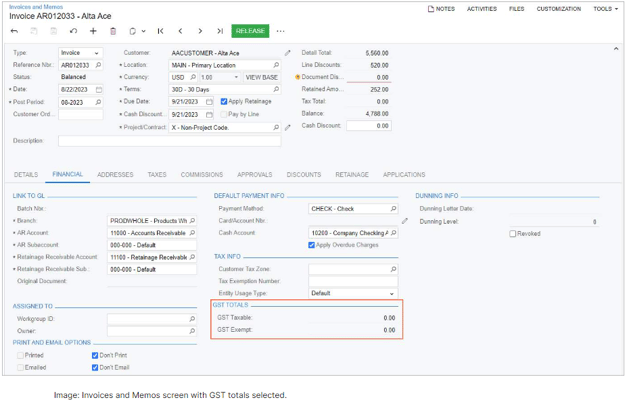

Changes to Summary Area Totals

Before the Spring Release, users had to manually crunch numbers for certain financial metrics or depend on less accurate summary area totals. This often caused discrepancies in financial records and increased the risk of errors. The new feature fixes these issues by offering more comprehensive and accurate summary area totals, cutting down the need for manual calculations and boosting overall financial management.

The MYOB Acumatica 2024.1 Release brings several updates to the totals in the Summary area of the following data entry forms:

- Invoices and Memos (AR301000)

- Bills and Adjustments (AP301000)

- Cash Sales (AR304000)

- Cash Purchases (AP304000)

These changes make the Summary area more user-friendly, eliminating the need for manual calculations and providing a smoother and more efficient experience.

The key benefits of this feature include:

- More detailed information in the summary area of forms like Opportunities, Sales Quotes, Invoices, and Memos.

- Accurate calculations of totals, including discounts, taxes, and margins.

- Simplified financial reporting by ensuring all relevant financial data is included in the summary area.

- Fewer manual calculations and potential errors by automating the calculation of key financial metrics.

Consolidated Retainage Invoices in AR (Construction Edition)

The key benefits of this feature include:

- Processing invoices with retained amounts.

- Better control over financial transactions.

- Improved cash flow forecasting.

- Less manual work.

- Boosted productivity.

Example use in MYOB Acumatica

You can now hold back part of the invoice amount until the job is done and pay the retained sum once all contract conditions are met. This feature is enabled through the Retainage Support feature on the Enable/Disable Features form. It lets you process invoices with retained amounts, giving you more control over your finances and improving cash flow forecasting.

The MYOB Acumatica 2024.1 Spring Release brings a wealth of enhancements designed to streamline your financial management processes, improve accuracy, and boost overall efficiency. From advanced cash purchase processing to comprehensive credit memo management, these features are tailored to meet the evolving needs of modern businesses.

For a deeper dive into how these updates can benefit your specific operations, explore our other blogs covering Sales and Customer Management, Project Management, Supply Chain Management, Production, Field Services, and Platform Enhancements.

Additionally, you can access the full release notes for a complete overview of all the new features and improvements.