We are excited to unveil a plethora of updates aimed at boosting your productivity. Fresh reports will be introduced to the payables workspace, allowing for a more streamlined tracking of liabilities by project. Whether you prefer a summary or detailed format, each report will furnish precise information on unreleased retentions.

Furthermore, enhancements in cash purchase processing will empower finance personnel to generate cash return documents for full or partial refunds, effectively managing situations where payments are made upfront without any existing liability. This innovative feature eliminates the need to void purchase documents, offering a comprehensive workflow for handling cash purchases. Additionally, this enhancement will seamlessly integrate into the bank deposits form, enabling easy inclusion of cash returns.

The Australian diminishing value depreciation method and the New Zealand diminishing value depreciation method will be reintegrated into the new depreciation engine, which operates on a declining balance algorithm. Tailored to meet regional requirements, these methods offer a more efficient calculation of depreciation amounts and their rounding.

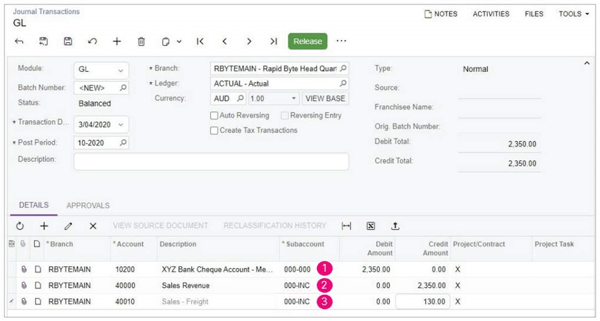

Changes in Copyright Default Subaccounts for GL Transactions

In MYOB Advanced 2023.1, the logic for defaulting the subaccount on the Journal Transactions (GL301000) form has been changed. This change ensures that the Income or Expense accounts subaccount isn’t defaulted to the Default Subaccount (usually used by Balance Sheet accounts) by mistake.

The screenshot below shows the following:

- The subaccount 000-00 is entered because it's the default in the 10200 account.

- The 40000 account has the Use Default Subaccount checkbox cleared, so the system leaves the Subaccount column empty, and the user should manually select the 000-INC.

- The 40010 account has the Use Default Subaccount checkbox selected, but it has the same type as the account on the line above. This is why the system inserts the subaccount from the previous line.

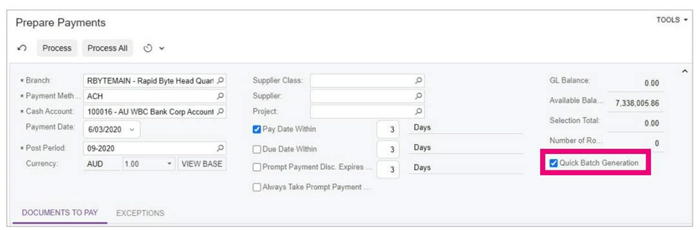

Generation of Batches on the Prepare Payments Form

In MYOB Advanced 2023.1, an optional shorter workflow is provided for supplier payments to be mass processed. Now, users can quickly generate a batch of payments from the Prepare Payments (AP503000) form, skipping the Process Payments (AP505000) form and going directly to the Batch Payments (AP305000) form.

New Quick Batch Generation columns have been added to the Payment Methods and Cash Accounts form.

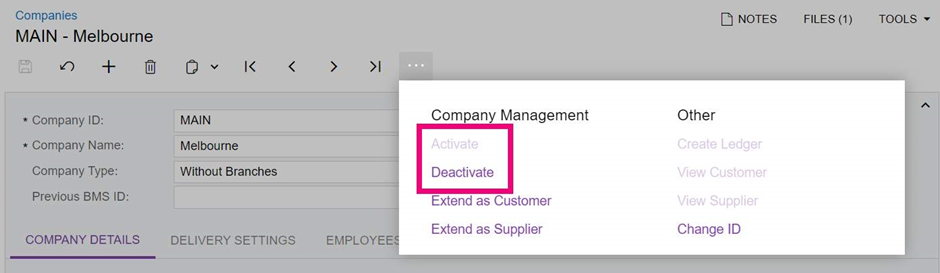

Generation of Financial Periods on Company Activation

In MYOB Advanced 2023.1, changes to the activation of Companies and generation of periods for inactive companies have been introduced. New actions on the Companies (CS101500) form have been added.

When a user activates an inactive company, the system compares the set of financial periods in the master calendar and the set of financial periods of the current company. If these sets are different, the system generates the missing periods in the company that is being activated (applicable if the Multiple Calendar Support feature is disabled).

GL Consolidation by Company

Starting in MYOB Advanced 2023.1, companies of the ‘With Branches Requiring Balancing’ and ‘With Branches Not Requiring Balancing’ types can also be selected as consolidation sources on the Consolidation (GL103000) form.

The newly labelled Source Company/Branch column displays a list of companies and branches according to the following rules:

- Both active and inactive companies are displayed.

- Companies of all types are displayed.

- Branches of companies with the 'With Branches Requiring Balancing' type are displayed.

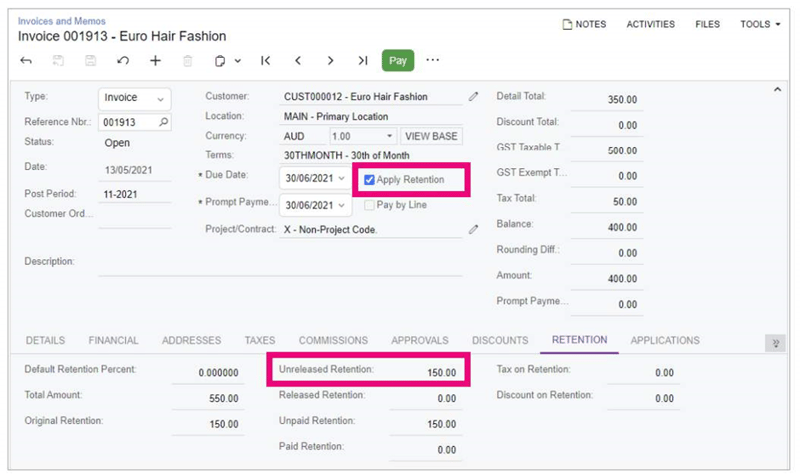

Migrated AR an AP Documents with Unreleased Retainage

Starting in MYOB Advanced 2023.1, migrated AR invoices and AP bills with unreleased retainage can be created directly on the Invoices and Memos (AR301000) and Bills and Adjustments (AP301000) forms, respectively. Previously, it was only possible to add these records via Import Scenario.

The Activate Migration Mode checkbox must be selected on the AR and AP Preferences forms. Then, the following field and tab will be displayed on the Invoices and Bills forms.

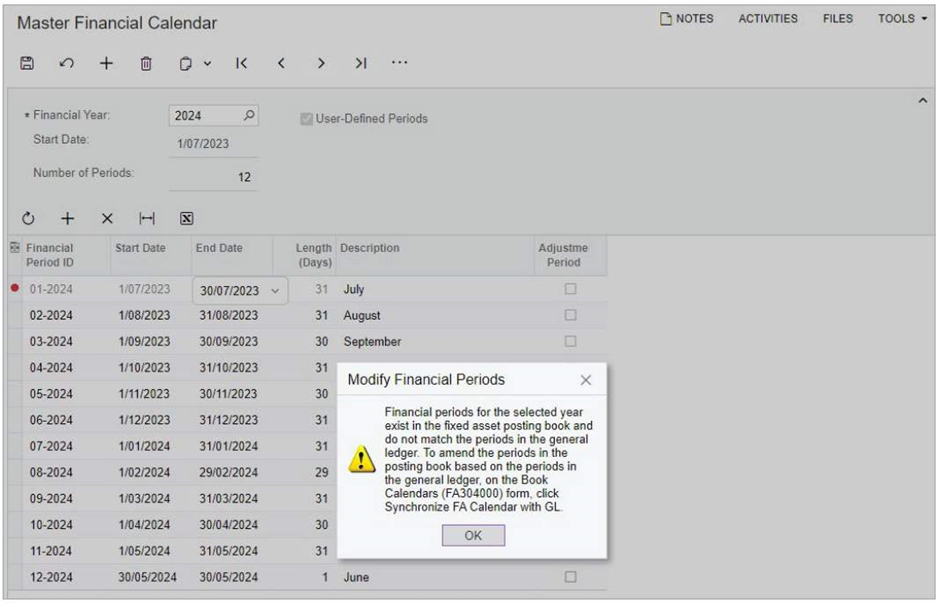

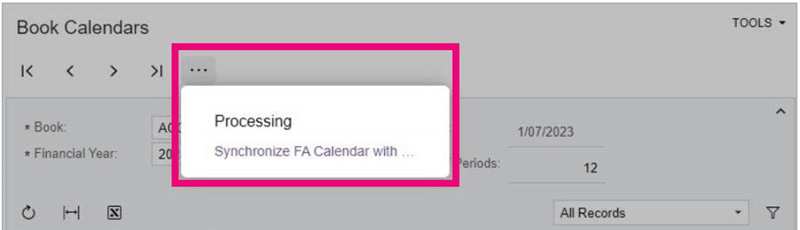

Synchronisation of Fixed Asset Periods with GL Periods

In MYOB Advanced 2023.1, users can adjust fixed asset periods to match the updated GL periods (e.g. changes to user-defined periods). Based on the amended periods, the system will recalculate and post depreciation transactions and other types of fixed asset transactions. For more information, click here to access release notes.

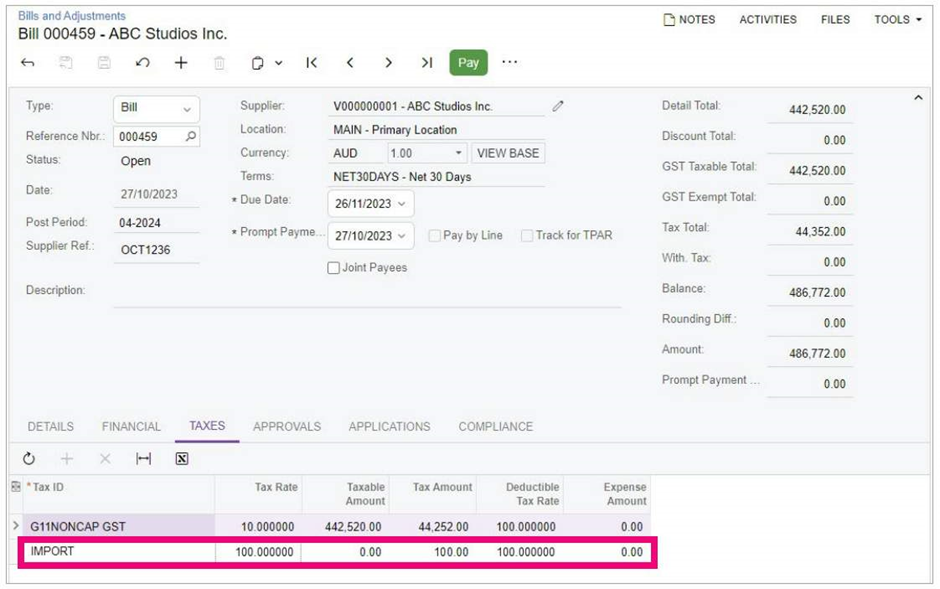

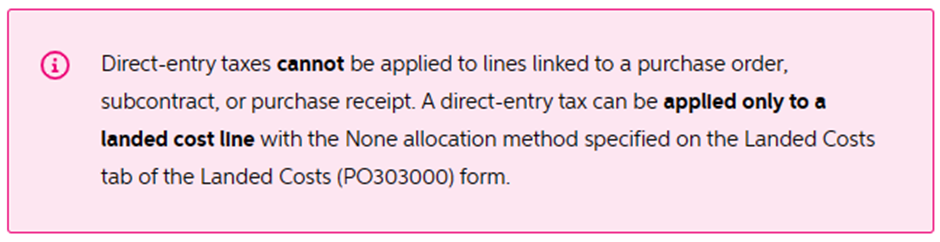

Tax Bills with Direct-Entry Taxes and Taxable Lines

In MYOB Advanced 2023.1, users can create AP documents (bills and cash purchases) and landed cost documents with direct-entry tax and expense lines. Direct-entry tax lines have taxable amounts of 0.

A Direct-Entry Tax column has been added to the Tax Categories and Tax Zones forms, allowing the following transaction to be entered into the Bills and Adjustments form in one transaction.

Other Finance Improvements

In MYOB Advanced 2023.1, multiple improvements to financial management processes have been introduced:

- Ability to Change the Type of Account with Posted Transactions

- Enhancement to the Tax Zone Validation introduced in Advanced 2022.2

- Availability of Payments by Line for Tax Agencies

- Availability of the Reverse Command for GL Revaluation Batches

- Reimplementation of the Australian Prime Cost Depreciation Method