Release focus: This post breaks down four practical Retail Commerce enhancements in MYOB Acumatica 2025.1:

- import orders without customers (Shopify & BigCommerce),

- import Shopify orders/payments/refunds in the default store currency,

- improved Shopify tax mapping (same name, different rates), and

- smarter Shopify price list sync (only items with effective prices).

Why this matters

- Lower admin overhead: Skip customer creation in Acumatica when you don’t need it.

- No multicurrency? No problem: Keep Shopify imports in one currency for simpler accounting.

- Accurate tax mapping: Handle duplicate tax names that differ by rate.

- Merchandising control: Show only SKUs with an effective price to the right customer catalogue.

1) Import Shopify/BigCommerce orders without importing customers

What’s changed

You can now import orders while assigning them to a generic guest customer—no individual customers created in Acumatica.

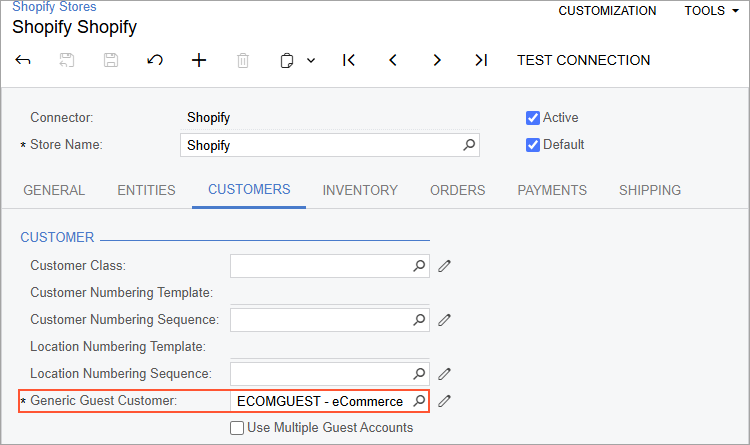

The guest customer specified for a Shopify store

How to configure

- Store form:

- Shopify Stores (BC201010) or BigCommerce Stores (BC201000).

- Entities tab:

- Sales Order → Sync Direction = Import.

- Customer → do not activate (leave Active unchecked).

- Customers tab:

- Set Generic Guest Customer to the account you want all imported orders to use.

Behaviour: Each imported order is created for the guest customer. On Sales Orders (SO301000), Override Contact and Override Address are ticked; ship-to/bill-to details are filled from the external order.

Outcome

- Faster onboarding; fewer records to maintain.

- Order-level addresses retained for fulfilment and tax—without cluttering your customer master.

2) Import Shopify documents in the default store currency

What’s changed

If you don’t need multicurrency accounting in Acumatica, you can import orders, payments, refunds from Shopify in the store’s default currency, regardless of checkout currency.

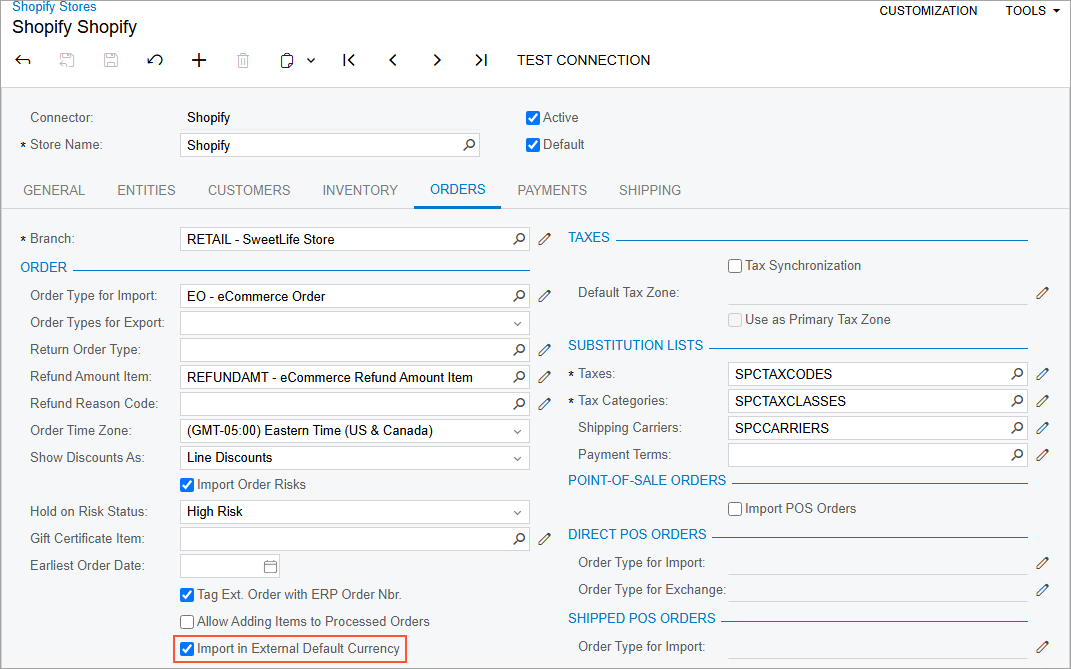

The new currency setting on the Shopify Stores form

How to configure

- Shopify Stores (BC201010) → Orders tab: check Import in External Default Currency.

- Payments tab: ensure mappings reference the default store currency.

Limitations & gotchas

- Orders already imported before you enable this setting keep their original (paid) currency; related documents continue in that currency.

- A credit-card payment imported in a currency different from the customer’s checkout currency can be captured/voided/refunded only in Shopify (not from Acumatica).

Outcome

- One-currency AR for simpler posting, reconciliation, and reporting.

3) Shopify taxes: map same-name, different-rate taxes

What’s changed

Tax mapping now supports duplicate names with different rates.

How to configure

- Create a Substitution List (SM206026) for taxes.

- In Original Value, specify either:

- <Tax Name> (if unique), or

- <Tax Name> <Rate>% (e.g., Arkansas State Tax 6.5%) when multiple rates share the same name.

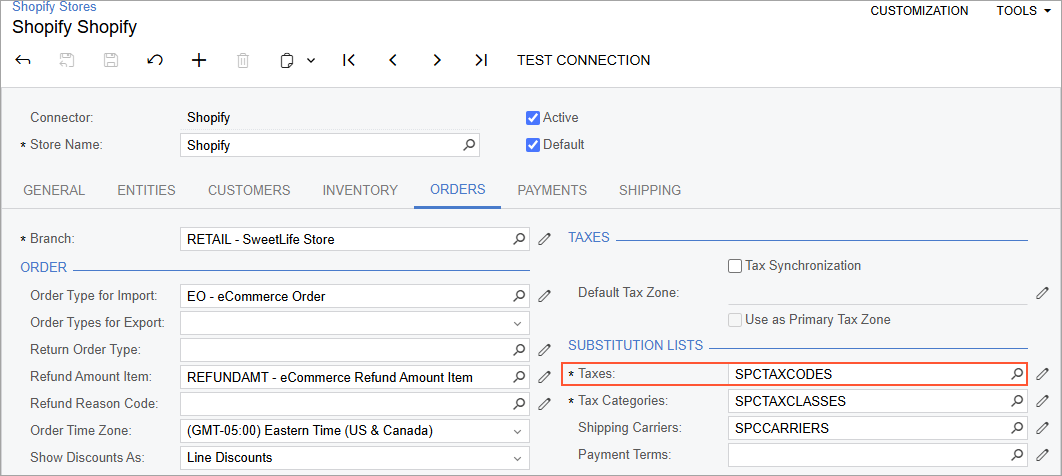

- On Shopify Stores (BC201010) → Orders tab, set Taxes to your substitution list.

Tip: Supplying name and rate also works when the name is unique.

Outcome

- Correct tax selection on import, fewer manual fixes.

The substitution list for taxes specified for a Shopify store

4) Shopify price lists: export only items with an effective price

What’s changed

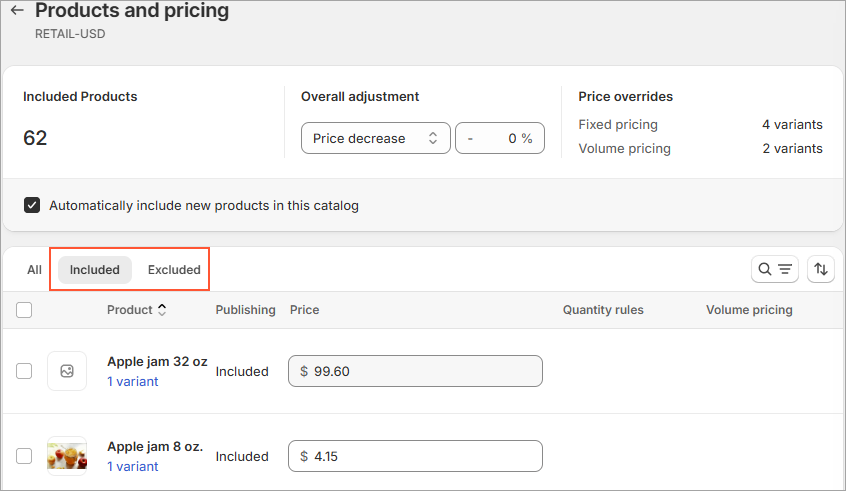

When syncing Price List for a Shopify store, Acumatica now builds customer catalogues that include only items whose prices in that price class are effective on the sync date. Others move to Excluded and are hidden from those customers.

The Included and Excluded sections of a product catalogue at a Shopify store

How it works

- The catalogue corresponds to the Customer Price Class (from Sales Prices – AR202000).

- On sync day, items with an effective price go to Included; items without an effective price go to Excluded.

Outcome

- Customers see the right products at the right prices; no zero-price surprises.

Quick “Do This Now” checklist

Admins / eCom Ops

- Decide if you can skip customer imports; set Generic Guest Customer per store.

- For single-currency accounting, enable Import in External Default Currency and update payment mappings.

- Build a Tax Substitution List; include <name> <rate>% rows where needed.

- Review Price Classes and ensure effective dates are set for items that should appear in Shopify catalogues.

Finance

- Validate GL postings with single-currency imports; test refunds/voids that must be actioned in Shopify.

Merchandising

- Audit which SKUs belong in each price class and confirm their effective dates before running the sync.

FAQs

Q: If I import with a guest customer, do I lose buyer info?

A: The Acumatica customer is the guest account, but order-level contact/address are retained via overrides for fulfilment and reporting.

Q: Can I mix—some stores with guest customer, others full customer sync?

A: Yes. Configure per store. You can also change later if your CRM needs evolve.

Q: What happens to previously imported multi-currency orders after I switch to default currency import?

A: They stay in their original currency; related documents continue in that currency.

Q: How precise must the tax rate string be?

A: Match Shopify’s display (e.g., 0.125%, 6.5%). Using name + rate is safest where duplicates exist.

Q: Why are some products invisible to certain customers after a price list sync?

A: They’re in the catalogue’s Excluded list because no effective price exists for that price class on the sync date.

How Avanza Solutions can help

- Configure guest customer flows and mappings for Shopify/BigCommerce.

- Set up default-currency imports and validate your accounting impacts.

- Build robust tax substitution lists and test edge cases.

- Tune price classes and catalogue sync so customers see exactly what they should—at the right price.

Want us to implement this in your sandbox and hand you a quick SOP for eCom + Finance teams? We can.